Standard Chartered Loan Calculator

Your Estimated Repayments

Estimated Monthly Payment (EMI)

This calculation is for illustrative purposes only and is not an offer of credit.

Standard Chartered Bank EMI Calculator Bangladesh – Quick Loan Estimator

The Standard Chartered Loan Calculator is a powerful tool that helps you estimate your monthly EMI (Equated Monthly Installment) in seconds. Whether you’re planning to take out a personal loan, home loan, or business loan, this calculator gives you a clear idea of how much you’ll need to repay every month based on the loan amount, interest rate, and loan tenure.

This tool is especially useful for borrowers who want to understand their repayment obligations before applying for a loan with Standard Chartered Bank. It helps you make smarter financial decisions with full visibility into your loan structure.

How the Standard Chartered Loan Calculator Works

The Standard Chartered Loan Calculator uses a simple, well-established formula to compute your monthly EMI. Based on three key inputs—loan amount, annual interest rate, and loan tenure—it calculates your fixed monthly payment, including both principal and interest components.

Input Fields Explained

- Loan Amount (P)

- This is the total loan amount you plan to borrow.

- The slider lets you choose between ₹1,00,000 and ₹5,00,00,000.

- Interest Rate (Annual – R)

- The annual interest rate charged by the bank, expressed as a percentage.

- You can adjust it based on your loan offer (e.g., 9.5%).

- Loan Tenure (Years – N)

- This is the total duration of your loan in years.

- You can select the tenure that suits your repayment capability.

EMI Calculation Formula

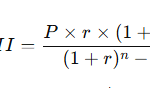

The EMI is calculated using the standard formula:

EMI = [P × r × (1 + r)^n] / [(1 + r)^n – 1]

Where:

- P = Loan Amount

- r = Monthly Interest Rate (Annual Rate ÷ 12 ÷ 100)

- n = Loan Tenure in Months (Years × 12)

This formula ensures you pay the same amount each month, making budgeting easier.

Example Calculation (Verification Section)

Let’s run a quick example to show how the calculator works.

Sample Input:

- Loan Amount: ₹20,00,000

- Interest Rate: 9.5% annually

- Loan Tenure: 5 years (60 months)

Based on this input, the calculator will output:

- Monthly EMI: ₹42,013 (approximate)

- Total Payment Over 5 Years: ₹25,20,780

- Total Interest Payable: ₹5,20,780

Interpretation:

This means you will pay ₹42,013 every month for 5 years. Over the loan term, you’ll repay a total of ₹25,20,780—out of which ₹5,20,780 is the interest. This breakdown helps you understand how much the loan is truly costing you and whether it fits into your budget.

As you explore loan adjustments, LoanCalculatorBD recalculates EMI instantly for better planning.

Benefits of Using This Calculator

Here’s why the Standard Chartered Loan Calculator is essential for loan planning:

- Instant Results – No need for manual calculations or Excel formulas.

- Simple and Interactive – Just move the sliders and enter values—results update instantly.

- Accurate Estimates – Based on standard EMI calculation logic, so you can trust the numbers.

- Budget-Friendly Planning – See how different loan amounts and tenures affect your EMI.

- Compare Loan Scenarios – Helps you evaluate various loan options before applying.

Tips and Common Mistakes

Useful Tips:

- Check your actual loan offer from Standard Chartered and input the exact interest rate for the most accurate result.

- Experiment with different tenures to find a balance between monthly affordability and total interest paid.

- Use the calculator as part of your financial planning to ensure your EMI fits within your monthly budget.

Common Mistakes to Avoid:

- Wrong Interest Rate – Enter the annual rate, not monthly.

- Ignoring Processing Fees – This calculator shows EMI only; total cost may include additional charges.

- Tenure Confusion – Make sure you’re entering years, not months.

- Overestimating Eligibility – Always check with the bank for the actual approved loan amount before relying solely on this estimate.

Common Questions / FAQs

1. Is this calculator only for personal loans?

No. While it’s commonly used for personal loans, the calculator works for any loan where EMI is calculated—home loans, auto loans, business loans, etc.

2. Can my EMI change during the tenure?

Only if your interest rate is variable (floating). If it’s fixed, your EMI remains constant for the entire term.

3. Does this calculator include processing fees or prepayment charges?

No. The EMI shown is purely based on loan amount, interest rate, and tenure. Any fees or penalties are excluded and should be confirmed with the bank.

4. Will I get the exact EMI from Standard Chartered shown here?

This is an estimate. Actual EMI may vary slightly based on rounding, compounding frequency, or other bank-specific policies.

5. How can I reduce my EMI?

You can lower your EMI by either increasing the loan tenure or negotiating a lower interest rate. However, a longer tenure may increase the total interest paid.

Conclusion

The Standard Chartered Loan Calculator is an essential tool for anyone considering a loan. It empowers you to make informed decisions, compare different loan scenarios, and prepare your monthly budget with confidence.