Applying for a bank loan in Bangladesh can feel overwhelming — but it doesn’t have to be.

If you know exactly what documents you’ll need and how to prepare them, the process becomes much faster and smoother.

This guide lists all documents required for personal, home, and business loans in Bangladesh, along with practical tips to help you get approved on the first try.

💡 Before you apply, estimate your monthly payments using our free Bank Loan Calculator or Personal Loan EMI Calculator.

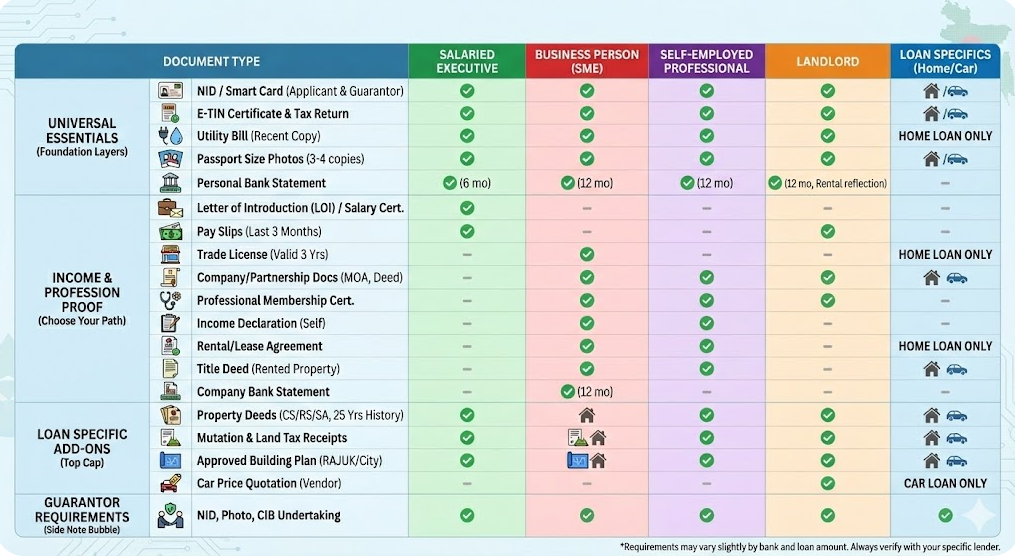

1. Basic Documents Required by All Banks

Most banks in Bangladesh follow similar documentation standards. Whether you’re applying at DBBL, BRAC Bank, EBL, or Prime Bank, you’ll usually need:

Personal Identification Documents

- National ID Card (Smart NID) or valid passport

- Recent passport-size photographs (usually 2–4 copies)

- Proof of address — such as utility bill, rental agreement, or municipality certificate

- Tax Identification Number (e-TIN) certificate

Income & Employment Proof

Depending on your occupation:

| Applicant Type | Required Documents |

|---|---|

| Salaried Person | Salary certificate, employment letter, last 3–6 months’ pay slips, and company ID card |

| Business Owner | Trade licence, business registration certificate, partnership deed (if applicable) |

| Freelancer / Self-Employed | Income statement, client invoices, and bank transaction records |

2. Financial and Bank Records

Banks verify your financial stability and repayment capacity before approving a loan.

You’ll need:

- Last 6–12 months of bank statements showing salary deposits or business transactions

- Existing loan or credit card statements (if applicable)

- Proof of other income sources, such as rental income or investments

💡 Use our Interest Calculator BD to understand how loan interest affects your total repayment.

3. Loan Purpose & Security Documents

Depending on the type of loan, you must include purpose-related documents:

| Loan Type | Additional Documents Required |

|---|---|

| Personal Loan | Completed loan application form, quotation or invoice (if purchasing goods) |

| Home Loan | Property ownership documents, khatian, mutation, land deed, or flat registration papers |

| Car Loan | Car quotation, proforma invoice, or registration documents |

| Business / SME Loan | Project profile, trade licence, TIN, VAT certificate, audited financials, and stock list |

| Education Loan | Admission letter, tuition invoice, student ID/passport copy |

For exact eligibility, visit our Home Loan Calculator or Installment Loan Calculator.

4. Guarantor & Collateral Documents

Some banks may ask for a guarantor or collateral security depending on your loan size and credit profile.

Guarantor Documents

- NID copy of guarantor

- 2 passport-size photos

- Bank statement (last 6 months)

- Proof of income or employment

Collateral Documents (if applicable)

- Land deed, mutation, or mortgage document

- Non-encumbrance certificate (NEC)

- Up-to-date municipal tax receipts

- Property valuation report

💡 Tip: For large home or business loans, submitting accurate property documents early helps you avoid weeks of delay during verification.

5. Quick Document Checklist by Loan Type

| Loan Type | Essential Documents |

|---|---|

| Personal Loan | NID, photo, salary certificate, pay slips, bank statements, TIN |

| Home Loan | NID, khatian, land deed, mutation, property valuation, income proof |

| Business Loan | Trade licence, TIN, VAT certificate, project profile, financials, collateral |

| Car Loan | NID, quotation, car registration papers, bank statement |

| Education Loan | Student ID, admission letter, sponsor’s income documents, TIN |

6. Pro Tips to Speed Up Loan Approval

✅ Keep documents consistent — name, address, and signatures must match across all forms.

✅ Submit complete bank statements (no missing months).

✅ Maintain a clean credit record — check your CIB (Credit Information Bureau) status.

✅ Apply for the right loan type — don’t over-declare income or hide liabilities.

✅ Prepare digital copies (PDFs) to upload on bank portals or share by email.

Bonus Tip: Use our EMI Calculator BD to plan monthly payments before submitting your application.

Frequently Asked Questions (FAQs)

1. Can I apply for a loan without an NID?

No. A valid National ID or passport is mandatory for KYC verification.

2. How many months of bank statements are required?

Most banks require 6 to 12 months of continuous statements.

3. What if I am self-employed or a freelancer?

You can submit income proof via trade licence, client invoices, or bank records showing deposits.

4. Is a guarantor always required?

Not for small personal loans, but most banks require one for home or business loans.

5. Can I get a loan without property documents?

Yes, if it’s unsecured. For home or business loans, property or asset documents are mandatory.

6. Do I need a TIN certificate?

Yes, especially for salaried, business, or high-value loans.

Key Takeaways:

- Gather identity, income, and bank documents before applying.

- Submit accurate property papers for secured loans.

- Keep your credit score clean for better interest rates.

- Always double-check document consistency (NID vs application form).

- Use calculators to estimate EMI and loan affordability.