BRAC Bank Loan Calculator

Estimate your monthly payments (EMI)

BRAC Bank Loan Calculator Bangladesh – Estimate Monthly Payments

The BRAC Bank Loan Calculator is a free and easy-to-use tool that helps you estimate your Equated Monthly Installment (EMI) based on your loan amount, interest rate, and tenure. Whether you're applying for a personal loan, home loan, or SME financing from BRAC Bank, this calculator instantly shows you how much you'll need to pay every month.

Using this BRAC Bank Loan Calculator gives you financial clarity before committing to a loan. It helps you understand repayment obligations, compare scenarios, and plan your budget more effectively.

How the BRAC Bank Loan Calculator Works

This EMI calculator uses the standard reducing balance method that most banks in Bangladesh—including BRAC Bank—follow for loan repayment. This method ensures the monthly EMI stays the same throughout the loan term, but the proportion of interest and principal changes with every payment.

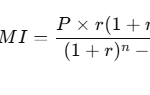

EMI Formula:

EMI = [P × R × (1 + R)^N] / [(1 + R)^N – 1]

Where:

- P = Loan amount (Principal)

- R = Monthly interest rate = (Annual Rate ÷ 12 ÷ 100)

- N = Loan tenure in months = (Years × 12)

Input Fields Explained:

- Loan Amount (BDT):

This is the total amount you want to borrow from BRAC Bank. For example,1000000BDT (10 lakh). - Annual Interest Rate (%):

The yearly interest rate offered on your loan. For example,10.5%. - Loan Tenure (Time):

This is the duration over which you’ll repay the loan. It’s entered in years and months. For example,5 yearsand0 months.

Once you enter these values and click "Calculate EMI", the calculator instantly shows:

- Monthly EMI (Equated Monthly Installment)

- Total interest payable

- Total repayment amount (Principal + Interest)

You can adjust loan amount and tenure easily because LoanCalculatorBD updates your EMI instantly.

Example Calculation – See It in Action

Let’s walk through a real-world example using the calculator:

Inputs:

- Loan Amount = BDT 10,00,000

- Annual Interest Rate = 10.5%

- Tenure = 5 years

Step-by-Step Calculation:

- Monthly Interest Rate (R): 10.5 ÷ 12 ÷ 100 = 0.00875

- Loan Tenure (N): 5 × 12 = 60 months

Now, plug into the formula:

EMI = [1000000 × 0.00875 × (1 + 0.00875)^60] / [(1 + 0.00875)^60 – 1]

EMI ≈ BDT 21,493

Total Calculations:

- Total Repayment = BDT 21,493 × 60 = BDT 12,89,580

- Total Interest Payable = BDT 12,89,580 – BDT 10,00,000 = BDT 2,89,580

Interpretation:

You will pay BDT 21,493 each month for 5 years. Over time, you’ll pay BDT 2,89,580 in interest, making the total repayment BDT 12,89,580.

This example helps you verify that the calculator is providing realistic and accurate results.

Benefits of Using This Calculator

- Instant Results: Get EMI, total interest, and repayment amount in seconds.

- Accurate & Transparent: Uses the official formula followed by banks.

- Easy to Use: No technical or financial background needed.

- Helps Budget Planning: Understand monthly commitments clearly before applying.

- Compare Scenarios: Change interest rates or tenures to find the best repayment plan.

Tips and Common Mistakes

Helpful Tips:

- Always double-check the interest rate with BRAC Bank—offers may vary based on loan type and profile.

- Try different loan tenures to see how EMI and interest change.

- Make sure your monthly income can comfortably support the EMI before applying.

Common Mistakes to Avoid:

- Entering commas in numbers (e.g.,

1,000,000instead of1000000) may cause errors. - Forgetting to enter months: Even

0should be added if there are no extra months. - Confusing tenure units: This tool separates years and months, so ensure both are filled.

- Assuming EMI includes fees: This tool calculates only based on principal and interest, excluding VAT, processing fees, or early repayment charges.

Frequently Asked Questions (FAQs)

1. Is the EMI calculated here final and fixed?

No. This calculator gives an estimated EMI. Final figures may vary based on BRAC Bank’s approval, fees, and actual disbursement schedule.

2. What types of loans can I use this calculator for?

You can use it for BRAC Bank personal loans, home loans, auto loans, and any other fixed-rate loan product.

3. Does the EMI include VAT or processing fees?

No. The EMI shown includes only principal and interest. Additional fees will be mentioned in your loan agreement.

4. Can I use this calculator for early repayment planning?

This calculator doesn’t account for early payments. But it helps you understand your base EMI so you can evaluate future decisions.

5. Is this tool accurate for partial prepayments?

No. Partial prepayments are not included in the standard EMI calculation. Contact BRAC Bank directly for those scenarios.

Conclusion

The BRAC Bank Loan Calculator is a powerful tool for anyone looking to estimate their monthly loan payments in advance. Whether you're a salaried individual, small business owner, or someone seeking financing from BRAC Bank, this calculator helps you plan better, borrow smart, and avoid surprises.