EBL Loan Calculator

Estimate your Equal Monthly Installment (EMI).

EBL Loan Calculator – Calculate EMI & Total Repayment in Bangladesh

The EBL Loan Calculator is an online tool that helps you estimate your Equal Monthly Installment (EMI) when applying for a personal loan from Eastern Bank Limited (EBL). Whether you're planning to finance a personal project, medical expense, or any large purchase, knowing your monthly repayment is crucial.

This tool uses your loan amount, interest rate, and loan tenure to calculate your EMI instantly. The EBL Loan Calculator simplifies financial planning by helping you stay informed about your repayment obligations.

How the EBL Loan Calculator Works

The calculator is based on the standard EMI formula used by most banks in Bangladesh, including EBL.

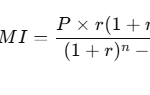

EMI Formula:

EMI = [P × R × (1+R)^N] / [(1+R)^N – 1]

Where:

P= Principal loan amount (in BDT)R= Monthly interest rate = Annual Rate / 12 / 100N= Loan tenure in months

Input Fields Explained:

- Loan Amount (BDT):

Enter the total amount you wish to borrow. For example, 500,000 BDT. - Annual Interest Rate (%):

Input the applicable annual interest rate (e.g., 10%). You can get this from EBL or estimate based on market averages. - Loan Tenure (Months):

Enter the number of months over which you plan to repay the loan. Common terms are 12, 36, 60 months, etc.

Once these inputs are filled in, click the “Calculate EMI” button. The tool will display:

- Your monthly EMI

- Total interest payable over the loan term

- The total repayment amount (Principal + Interest)

Example Calculation (Verification Section)

Let’s see a sample calculation to understand how the EBL Loan Calculator works:

Input:

- Loan Amount: BDT 500,000

- Annual Interest Rate: 10%

- Loan Tenure: 60 months

Step-by-Step:

- Convert annual interest rate to monthly:

- R = 10 / 12 / 100 = 0.00833

- Apply to EMI formula:

EMI = [500000 × 0.00833 × (1 + 0.00833)^60] / [(1 + 0.00833)^60 – 1] ≈ BDT 10,624 - Total Payment = 10,624 × 60 = BDT 637,440

- Total Interest = 637,440 – 500,000 = BDT 137,440

Interpretation:

You will pay around BDT 10,624 per month, and the total interest paid over 5 years will be approximately BDT 137,440.

Benefits of Using This Calculator

- Quick and Accurate: Instantly calculates EMI with bank-standard formulas

- Saves Time: No manual calculations or spreadsheets needed

- Easy to Use: Simple inputs and instant results make it accessible to everyone

- Helps with Planning: Know your repayment schedule before applying for the loan

- Supports Smart Borrowing: Compare different loan amounts and terms for best fit

When deciding your loan amount, LoanCalculatorBD shows how EMI changes based on your input.

Tips and Common Mistakes

Helpful Tips:

- Always check the latest interest rate from EBL for the most accurate results

- Consider your monthly budget to ensure you can afford the EMI

- Use the calculator to compare different tenures to see how EMI and total interest change

Common Mistakes to Avoid:

- Confusing loan tenure in months vs. years—always enter tenure in months

- Forgetting to include additional bank fees or charges (this calculator does not factor in processing fees)

- Using outdated or estimated interest rates without confirming with the bank

Frequently Asked Questions (FAQs)

1. What is the EBL Loan Calculator used for?

It helps estimate your monthly installment (EMI), total interest, and total repayment for a loan from Eastern Bank Limited.

2. Is the EMI calculated here exactly what I’ll pay to the bank?

It’s a close estimate. Your actual EMI may vary slightly based on EBL's processing fees, documentation charges, or negotiated interest rates.

3. Can I use this calculator for business loans?

Yes, as long as your business loan from EBL follows the EMI repayment model. For special cases like bullet payments, consult the bank.

4. Does the calculator include taxes or VAT?

No. The calculation is based on principal and interest only. Taxes or fees imposed by the bank or government are excluded.

5. What if I miss a monthly EMI payment?

This calculator does not account for penalties. For missed payments, EBL may charge late fees. Contact the bank for exact policies.

Conclusion

The EBL Loan Calculator is an essential financial planning tool for individuals considering a personal loan from Eastern Bank Limited. By using this calculator, you can estimate your EMI, understand your financial commitment, and avoid surprises during repayment.