Loan Calculator Bangladesh

Easily calculate your monthly EMI, total interest, and overall loan repayment using our accurate loan calculator designed specifically for Bangladesh. This tool helps borrowers understand repayment obligations for home loans, personal loans, and bank loans before applying to any financial institution.

Loan Calculator BD

EMI, Interest & Yearly Breakdown

| Year | Interest | Principal | Balance |

|---|

What Is a Loan Calculator & Why It Matters

A loan calculator is a financial tool that helps borrowers estimate their monthly installment (EMI), total interest cost, and overall repayment amount before taking a loan. By entering the loan amount, interest rate, and loan tenure, a loan calculator instantly shows how much you may need to pay every month and over the full loan period.

Tools like this EMI calculator for Bangladesh are especially useful because loan terms vary across banks, loan types, and repayment structures. A clear estimate helps you understand the financial commitment before signing any loan agreement.

Why Loan Calculation Is Important in Bangladesh

In Bangladesh, interest rates, repayment periods, and installment structures can differ significantly between banks and financial institutions. Borrowers often focus on loan approval but overlook how monthly repayments will affect their regular expenses.

Using a loan calculator before applying allows you to:

- Estimate a monthly EMI that fits your income and budget

- Compare different loan tenures and interest rates

- Understand the true cost of borrowing, including total interest

- Avoid repayment pressure after loan disbursement

This is particularly important when planning long-term commitments such as a home loan or evaluating different options through a bank loan calculator.

How a Loan Calculator Helps You Make Better Financial Decisions

A loan calculator helps you test different scenarios before choosing a loan. By adjusting the loan amount, interest rate, or repayment period, you can see how small changes affect your monthly EMI and total repayment.

This makes it easier to compare loan options, plan future expenses, and choose a loan structure that matches your long-term financial goals. Instead of guessing, you can make informed decisions backed by clear estimates.

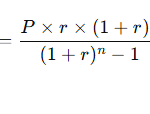

How the Loan Calculator Works

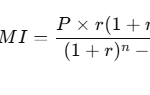

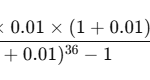

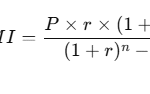

The loan calculator works by using three basic inputs: loan amount, interest rate, and loan tenure. Based on these values, it calculates your expected monthly installment (EMI) and the total cost of the loan. This allows you to understand your repayment responsibility before applying for a loan.

The calculation process used in this tool is similar to the method followed by banks and financial institutions in Bangladesh when determining monthly installments for personal loans, home loans, and other installment-based loans.

Step 1: Enter the Loan Amount

The loan amount is the total money you plan to borrow from a bank or financial institution. This amount directly affects both your monthly EMI and the total interest you will pay over time.

Whether you are planning a home loan or a short-term personal loan, entering the correct loan amount helps you estimate realistic repayment figures.

Step 2: Set the Interest Rate

The interest rate represents the cost of borrowing money, usually expressed as an annual percentage. In Bangladesh, interest rates vary depending on the loan type, bank policies, and market conditions.

By adjusting the interest rate in the calculator, you can see how different rates impact your monthly EMI and total interest payable. This is especially useful when comparing offers from different banks using a bank loan calculator.

Step 3: Choose the Loan Tenure

Loan tenure refers to the total repayment period, usually measured in years. A longer tenure generally reduces the monthly EMI but increases the total interest paid, while a shorter tenure results in higher EMI with lower total interest.

The calculator allows you to test different loan tenures so you can find a balance between affordable monthly payments and overall loan cost.

Step 4: Review Your EMI and Total Loan Cost

Once you enter all the required details, the calculator shows your estimated monthly EMI, total interest amount, and total payable loan cost. These results give you a clear picture of your financial commitment.

For a deeper understanding of how EMIs are calculated, you can also explore our guide on how to calculate EMI in Bangladesh .

Loan Types Covered in Bangladesh

Different types of loans serve different financial needs. In Bangladesh, banks and financial institutions offer various loan products with distinct interest rates, repayment structures, and eligibility requirements. This loan calculator helps you estimate EMI and total repayment for the most common loan types so you can compare options before applying.

Home Loans

Home loans are long-term loans used to purchase, build, or renovate residential property. These loans usually come with lower interest rates and longer repayment periods compared to other loan types.

Before committing to a long tenure, it is important to understand how monthly EMI and total interest change over time. You can explore this in more detail using our home loan calculator.

Personal Loans

Personal loans are unsecured loans commonly used for education, medical expenses, travel, or emergency needs. Because these loans do not require collateral, interest rates are generally higher and repayment periods are shorter.

Calculating EMI in advance helps ensure that the monthly installment remains affordable. You can estimate repayments using our personal loan calculator or compare EMI structures through the personal loan EMI calculator.

Car and Vehicle Loans

Car loans and other vehicle loans are typically medium-term loans used to finance new or used vehicles. Monthly installments depend on the vehicle price, down payment, interest rate, and loan tenure.

Estimating EMI beforehand helps you choose a repayment plan that fits your income while accounting for additional costs such as insurance and taxes.

Bank and Installment Loans

Banks in Bangladesh offer a wide range of installment-based loan products, including salary loans, consumer loans, and small business loans. Interest rates and terms vary across banks, making comparison essential.

To evaluate different bank offers, you can use the bank loan calculator and compare EMI and total repayment amounts before selecting a lender.

Why Use LoanCalculatorBD

Choosing the right loan requires more than knowing whether you qualify. You need clear, reliable information about monthly installments, total interest, and long-term repayment impact. LoanCalculatorBD is built to provide accurate, easy-to-understand loan estimates tailored specifically for borrowers in Bangladesh.

Unlike generic calculators, this platform focuses on local banking practices, common interest rate structures, and repayment patterns used by banks and financial institutions across Bangladesh.

Designed for Bangladesh-Based Borrowers

LoanCalculatorBD is created with the needs of Bangladeshi borrowers in mind. Whether you are comparing a home loan, planning a personal loan, or reviewing different bank offers, the calculator reflects how loans are commonly structured in Bangladesh.

This local focus helps you make more realistic financial plans instead of relying on assumptions based on foreign or generic loan tools.

Clear, Instant, and Easy to Use

The calculator is designed to be simple and fast. By entering just three values—loan amount, interest rate, and tenure—you can instantly see your estimated EMI, total interest, and total payable amount.

This makes it easier to compare scenarios, test different repayment periods, and understand how changes in interest rates affect your loan cost. You can also explore specific tools such as the EMI calculator for Bangladesh for more focused calculations.

Supports Informed Financial Decisions

LoanCalculatorBD is not designed to sell financial products. Its purpose is to help users make informed decisions by understanding loan costs before applying. This reduces the risk of taking on unaffordable repayments and long-term financial stress.

For users who want to compare offers from different banks, the bank loan calculator helps highlight differences in EMI and total repayment across lenders.

Free, Private, and Transparent

All calculators on LoanCalculatorBD are free to use and do not require account creation or personal data submission. Calculations are performed instantly, and no user information is stored.

Transparency is a priority. Results are presented clearly, along with notes explaining that final loan terms depend on bank policies and individual loan agreements.

Popular Bank Loan Calculators in Bangladesh

Loan terms and interest rates can vary widely between banks in Bangladesh. Even for the same loan amount and tenure, monthly EMI and total repayment may differ depending on the lender’s pricing and repayment structure. Exploring bank-specific loan calculators helps you compare options more accurately before making a decision.

Below are some of the most commonly used bank loan calculators on LoanCalculatorBD, covering public, private, and international banks operating in Bangladesh.

State-Owned and Local Banks

- Agrani Bank Loan Calculator – Estimate EMI and repayment cost for Agrani Bank loan products.

- Dutch-Bangla Bank (DBBL) Loan Calculator – Calculate installments for personal and other DBBL loans.

- DBBL Home Loan Calculator – Estimate long-term EMI for DBBL home financing.

- Islami Bank Loan Calculator – Plan repayments for Islami Bank loan facilities.

Private Commercial Banks

- BRAC Bank Loan Calculator – Calculate EMI for BRAC Bank personal and other loan products.

- Prime Bank Loan Calculator – Estimate monthly installments and total loan cost.

- Mutual Trust Bank (MTB) Loan Calculator – Compare EMI options for MTB loan offerings.

- Eastern Bank Limited (EBL) Loan Calculator – Evaluate repayment structure for EBL loans.

International and Specialized Financial Institutions

- Standard Chartered Loan Calculator – Estimate EMI for Standard Chartered personal loan products.

- Citibank Loan Calculator – Calculate loan installments based on Citibank terms.

- IDLC Loan Calculator – Plan repayments for IDLC Finance loan products.

- IFIC Bank Loan Calculator – Compare EMI and total repayment for IFIC Bank loans.

If you want to compare loan terms across multiple banks at once, you can also use the general bank loan calculator to test different interest rates and tenures side by side.

Related Financial Tools & Calculators

Financial planning often involves more than just calculating loan installments. Along with estimating EMI, many borrowers and individuals need to evaluate taxes, savings, education results, and other personal finance factors. LoanCalculatorBD provides a range of financial calculators to support these broader planning needs.

These tools are designed for common financial situations in Bangladesh and can be used alongside the loan calculator to make more informed decisions.

Tax and Income-Related Calculators

- Income Tax Calculator Bangladesh – Estimate annual income tax based on current tax slabs.

- Salary Tax Calculator – Calculate monthly and yearly tax deductions for salaried employees.

- Pension Calculator Bangladesh – Estimate retirement pension based on service period and salary.

- Provident Fund Calculator – Plan long-term savings through provident fund contributions.

Education and Academic Calculators

- CGPA Calculator (Bangladesh) – Calculate cumulative grade point average for university students.

- SSC GPA Calculator – Estimate GPA based on SSC exam results.

- HSC GPA Calculator – Calculate GPA for HSC examinations in Bangladesh.

Household and Utility Calculators

- Electricity Bill Calculator – Estimate monthly electricity bills based on usage.

- Duty Calculator Bangladesh – Calculate customs duty and tax for imported goods.

- Distance Calculator – Measure distance between locations within Bangladesh.

Health and Personal Planning Tools

- BMI Calculator – Calculate body mass index for basic health assessment.

- Pregnancy Calculator – Estimate important pregnancy dates and milestones.

EMI Basics & Financial Education

Equated Monthly Installment (EMI) is the fixed amount a borrower pays every month to repay a loan. Each EMI consists of two parts: the principal amount (the original loan) and the interest charged by the lender. Understanding how EMI works is essential before taking any loan, as it directly affects your monthly budget and long-term financial stability.

Our EMI calculator for Bangladesh helps you visualize these payments clearly by showing monthly EMI, total interest, and total repayment amount based on your loan details.

What Factors Affect Your EMI?

Several key factors influence the EMI amount you need to pay each month. Even small changes in these factors can significantly impact your total loan cost over time.

- Loan Amount: Higher loan amounts increase both EMI and total interest.

- Interest Rate: A higher rate results in higher monthly installments.

- Loan Tenure: Longer tenures reduce EMI but increase total interest paid.

By adjusting these values in the calculator, you can test different scenarios and choose a structure that fits your income and financial goals.

How EMI Changes Over the Loan Period

In the early months of a loan, a larger portion of each EMI goes toward interest, while a smaller portion reduces the principal. As time passes, the interest component decreases and more of the EMI is applied to the principal. This repayment pattern is commonly used by banks in Bangladesh.

Understanding this structure helps borrowers plan better and avoid surprises when reviewing loan statements or prepayment options.

Common EMI Mistakes to Avoid

Many borrowers make decisions based only on whether they can afford the EMI today, without considering long-term implications. Some common mistakes include:

- Choosing a very long tenure just to reduce monthly EMI

- Ignoring total interest payable over the loan period

- Not comparing loan offers across different banks

- Overlooking additional fees and charges

Comparing options using a bank loan calculator or reviewing guides such as how to calculate EMI in Bangladesh can help you avoid these issues.

Using EMI Calculations for Better Financial Planning

EMI calculations are not only useful for loan approval but also for long-term financial planning. By understanding how much of your income will go toward loan repayment, you can plan savings, investments, and other expenses more effectively.

This approach is especially important when comparing major commitments such as a personal loan vs home loan , where the repayment structure and long-term impact can differ significantly.

Frequently Asked Questions (FAQ)

What is a loan calculator?

A loan calculator is an online tool that helps estimate monthly EMI, total interest, and total repayment amount for a loan. By entering the loan amount, interest rate, and tenure, borrowers can understand their repayment obligations before applying for a loan.

How accurate is the loan calculator?

The loan calculator provides close estimates based on the information you enter. However, actual EMI and repayment amounts may vary depending on bank policies, processing fees, insurance costs, and final interest rates. For planning purposes, the estimates are generally reliable.

Is this loan calculator suitable for Bangladesh?

Yes. This calculator is designed specifically for Bangladesh and reflects common loan structures used by local banks and financial institutions. You can also explore the dedicated EMI calculator for Bangladesh for more focused calculations.

Can I calculate EMI for different banks?

Yes. While this calculator provides general estimates, LoanCalculatorBD also offers bank-specific tools. You can compare repayment structures using the bank loan calculator or explore calculators for individual banks listed on this page.

What information do I need to use the loan calculator?

You only need three basic details: the loan amount, annual interest rate, and loan tenure. No personal or financial documents are required to use the calculator.

Does using the loan calculator affect my loan approval?

No. Using the loan calculator does not affect loan approval or credit assessment. It is a planning tool only and does not share your data with any bank or financial institution.

Is the loan calculator free to use?

Yes. All calculators on LoanCalculatorBD are free to use and do not require registration. You can use them as often as needed to compare loan options and plan your finances.

Where can I learn more about EMI calculation?

If you want a deeper understanding of how EMI is calculated, you can read our detailed guide on how to calculate EMI in Bangladesh .

Trust, Accuracy & Disclaimer

LoanCalculatorBD is designed to help users understand loan repayment structures before applying for a loan. All calculators on this website provide estimates based on the information entered by users and commonly used calculation methods in Bangladesh.

While we aim to keep calculations accurate and up to date, actual loan terms may vary depending on bank policies, borrower eligibility, interest rate changes, and additional fees or charges applied by financial institutions.

Accuracy of Calculations

The results generated by our loan and EMI calculators are intended for planning and comparison purposes only. Banks may calculate installments differently based on compounding methods, rounding rules, insurance premiums, processing fees, or promotional interest rates.

To make informed decisions, users are encouraged to confirm final EMI, interest rates, and repayment schedules directly with the bank or financial institution before applying for a loan.

No Financial Advice

The content and tools provided on LoanCalculatorBD do not constitute financial, legal, or professional advice. Calculator results should not be treated as a guarantee of loan approval or final repayment terms.

Users should assess their financial situation carefully and consult with qualified professionals or lenders when making significant financial commitments.

Privacy and Data Use

LoanCalculatorBD does not require users to submit personal information to use the calculators. All calculations are performed instantly, and no loan data is stored or shared with third parties.

For more information about this website and its purpose, you may visit our About page or contact us through the Contact page.