Managing personal finance is no longer just about keeping a diary of expenses — it’s about making data-driven decisions.

Whether you’re planning a home loan, managing your taxes, or calculating your future savings, the right financial calculator can help you make smarter choices in seconds.

Here are the top financial calculators every Bangladeshi should use in 2025, tailored for salary earners, business owners, and students alike.

💡 All calculators listed below are available for free on LoanCalculatorBD.com.

1. EMI Calculator BD – Know Your Monthly Payments

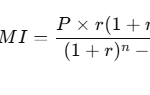

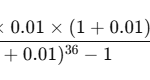

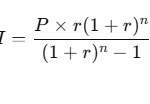

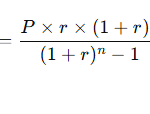

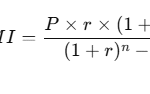

The EMI Calculator BD helps you determine how much you’ll pay every month for your loan.

It’s essential if you’re planning to take a personal loan, home loan, or car loan.

Why use it?

- Instantly calculates EMI, total interest, and total payable amount.

- Helps you decide the right loan tenure.

- Shows how small prepayments can reduce interest.

🔹 Ideal for: Home buyers, salaried employees, and business owners.

Tip: Check how prepaying can save interest using our guide — Understanding EMI Prepayment in Bangladesh.

2. Bank Loan Calculator – Compare Borrowing Costs

The Bank Loan Calculator is designed to help you compare different loan options from banks like BRAC Bank, DBBL, and Prime Bank.

What it does:

- Calculates total interest based on rate and tenure.

- Displays detailed repayment schedule (month-by-month).

- Lets you compare offers from multiple banks.

🔹 Best for: Entrepreneurs and SMEs choosing between bank loans.

Learn more: How to Choose the Right Bank Loan for Your Business in Bangladesh

3. Interest Calculator BD – Simple vs Compound

The Interest Calculator BD lets you calculate how your money grows over time under both simple and compound interest.

Use it for:

- Fixed Deposits (FDs)

- DPS or Provident Fund returns

- Comparing investment plans

| Type | Example | Growth Impact |

|---|---|---|

| Simple Interest | 10% on Tk 100,000 for 3 years = Tk 30,000 | Linear growth |

| Compound Interest | 10% compounded yearly = Tk 33,100 | Faster growth |

Read our guide: How Interest Works on Loans – Simple vs Compound

4. Income Tax Calculator BD – Estimate Your Tax Liability

The Income Tax Calculator BD helps you estimate how much income tax you owe based on the latest NBR Tax Slabs for FY 2025–26.

Why it matters:

- Uses official NBR tax rates.

- Considers rebates, exemptions, and deductions.

- Perfect for salaried professionals and freelancers.

Bonus: Read NBR Tax Updates You Should Know (FY 2025–26) to stay compliant.

5. Salary Tax Calculator BD – Understand Your Net Pay

The Salary Tax Calculator BD shows your take-home salary after tax.

It’s ideal for employees who want to budget better or negotiate salaries.

Features:

- Calculates gross vs. net pay.

- Includes personal allowances and rebates.

- Helps track monthly deductions.

Combine this with our 10 Money-Saving Tips for Working Professionals for smarter financial planning.

6. Home Loan Calculator – Plan Your Dream House

Buying a home is one of life’s biggest financial commitments.

The Home Loan Calculator helps you estimate EMIs, interest payable, and total loan cost.

Why it’s essential:

- Compare rates from top banks (BRAC, DBBL, SCB).

- Find the most affordable EMI plan.

- Plan for prepayments to save interest.

See our full analysis: Top 5 Banks Offering the Lowest Home Loan Rates in 2025

7. Provident Fund Calculator – Secure Your Retirement

The Provident Fund Calculator helps government and private employees track contributions and estimate future corpus.

Why it’s useful:

- Calculates employer + employee contribution growth.

- Includes annual interest.

- Visualizes total savings at retirement.

Learn more: Provident Fund (GPF) Rules and Calculation in Bangladesh

8. Pension Calculator BD – Plan for Life After Work

The Pension Calculator BD helps retired or soon-to-retire employees estimate monthly pension income.

Key Benefits:

- Calculates pension based on salary and service years.

- Accounts for commutation and gratuity options.

- Works for both government and private pensions.

9. Duty Calculator BD – For Importers and Vehicle Buyers

If you’re importing goods or purchasing a car, the Duty Calculator BD estimates your customs duty, VAT, and AIT.

Use Cases:

- Car importers estimating duty before purchase.

- E-commerce or shipping businesses managing costs.

- Entrepreneurs importing goods for resale.

Related: Car Tax Calculator BD for vehicle tax estimates.

10. Bangladesh Electricity Bill Calculator – Manage Utility Costs

Electricity costs are rising — and often unpredictable.

The Bangladesh Electricity Bill Calculator helps you estimate your monthly bill based on usage and tariff.

Why it’s handy:

- Calculate household or business energy expenses.

- Helps detect overbilling or excessive consumption.

- Perfect for budgeting recurring costs.

Combine with our BMI Calculator or CGPA Calculator BD to explore more utilities beyond finance.

Bonus: Why Use Financial Calculators Regularly

| Benefit | Description |

|---|---|

| Accuracy | Avoid guesswork and get real-time numbers. |

| Better Planning | Make informed decisions on loans and investments. |

| Time-Saving | Instant results vs manual calculations. |

| Smart Budgeting | Manage monthly cash flow effectively. |

Regular use of these calculators turns financial planning into a routine, not a chore.

SADIP is the creator of LoanCalculatorBD.com, a trusted resource for accurate and easy-to-use financial calculators tailored for users in Bangladesh. With a deep understanding of personal finance and local banking needs, SADIP is dedicated to helping individuals make smarter loan decisions. His mission is to simplify complex calculations and empower users with clear, reliable tools for managing their finances with confidence.