Citibank Loan Calculator

Estimate your monthly payments and total interest

Payment Summary

Citibank Loan Calculator BD – Calculate Your EMI in Bangladesh

The Citibank Loan Calculator is a powerful and easy-to-use tool that helps you estimate your monthly EMI (Equated Monthly Installment) for loans offered by Citibank. Whether you’re planning to apply for a personal loan, auto loan, or home financing, this calculator allows you to input your loan amount, interest rate, and repayment tenure to see your expected monthly payments instantly.

Using this Citibank loan calculator allows you to make informed financial decisions, compare loan scenarios, and manage your monthly budget more effectively—before you even apply.

How the Citibank Loan Calculator Works

This calculator uses the standard EMI formula based on a reducing balance method, the same method used by most banks, including Citibank. It assumes a fixed interest rate throughout the loan term.

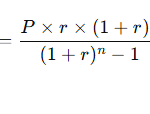

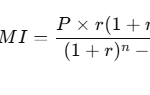

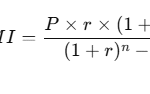

EMI Formula:

EMI = [P × R × (1 + R)^N] / [(1 + R)^N – 1]

Where:

- P = Loan Amount (Principal)

- R = Monthly Interest Rate = Annual Interest Rate ÷ 12 ÷ 100

- N = Loan Tenure in Months = Years × 12

Input Fields Explained:

- Loan Amount (P):

Enter the total amount you wish to borrow, e.g., $50,000. - Annual Interest Rate (R):

Enter the annual interest rate for your loan. For example, 10.5% would be entered as10.5. - Loan Tenure (N):

Choose the number of years over which you plan to repay the loan, e.g., 5 years.

Once you click “Calculate,” the calculator displays your:

- Monthly Payment (EMI)

- Total Interest Paid

- Total Amount Payable (Principal + Interest)

Whether it’s a personal or home loan, LoanCalculatorBD helps you check affordability.

Example Calculation – Verify Your EMI Output

Let’s assume the following:

- Loan Amount: $50,000

- Interest Rate: 10.5% annually

- Tenure: 5 years

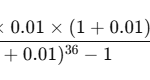

Step-by-Step Breakdown:

- Monthly Interest Rate (R) = 10.5 ÷ 12 ÷ 100 = 0.00875

- Total Number of Payments (N) = 5 × 12 = 60

Using the formula:

EMI = [50000 × 0.00875 × (1 + 0.00875)^60] / [(1 + 0.00875)^60 – 1]

EMI ≈ $1,073.64

Final Output:

- Monthly EMI: ~$1,073.64

- Total Payment: $1,073.64 × 60 = $64,418.40

- Total Interest Payable: $64,418.40 – $50,000 = $14,418.40

What This Means:

If you borrow $50,000 at 10.5% for 5 years, your monthly EMI will be around $1,073.64. Over the course of the loan, you’ll pay about $14,418.40 in interest. This helps you determine whether the loan fits your budget.

Benefits of Using This Calculator

- Instant Calculations: No need for manual math or spreadsheets.

- Accurate Estimations: Uses the same EMI formula banks apply.

- Flexible Scenarios: Test different loan amounts, interest rates, and tenures.

- Financial Planning: Know your monthly obligations before taking out a loan.

- User-Friendly Interface: Simple sliders and clean layout for effortless use.

Tips and Common Mistakes

Helpful Tips:

- Check Citibank’s latest loan rates before calculating.

- Use realistic inputs to reflect your actual borrowing capacity.

- Test both shorter and longer tenures to find a balance between EMI and total interest.

Common Mistakes:

- Confusing Annual and Monthly Interest Rates: Always input the annual rate — the calculator converts it.

- Ignoring Total Payable Amount: Many users only check EMI, but total interest is just as important.

- Using Unrealistic Tenures: Choosing an extremely short tenure may produce high EMIs that aren’t sustainable.

- EMI Calculator BD – to compare EMI across different loan providers

- Personal Loan Calculator – relevant for Citibank personal loan users

- Bank Loan Calculator – broader comparison with other banks in Bangladesh

- Interest Calculator BD – helps users understand interest impact

- Standard Chartered Loan Calculator – logical alternative bank comparison

- How to Calculate EMI in Bangladesh – educational support for loan calculation logic

Frequently Asked Questions (FAQs)

1. Is this calculator official from Citibank?

No. This is an independent EMI calculator based on the official formula, designed to estimate payments for Citibank loans.

2. Can I use this for Citibank personal loans, auto loans, or home loans?

Yes. This calculator can be used for any fixed-rate loan product offered by Citibank.

3. Does the EMI include taxes or processing fees?

No. The EMI shown is based on principal and interest only. Citibank may add additional fees depending on the product.

4. Can I calculate prepayment impact here?

This calculator does not currently support prepayment scenarios, but Citibank allows early repayment under certain conditions.

5. Will my actual EMI differ from this estimate?

Possibly. This tool provides a close approximation. Final figures depend on your credit profile and Citibank’s approval.

Conclusion

The Citibank Loan Calculator is an essential planning tool for anyone considering a loan with Citibank. It helps you estimate your monthly payments, understand total interest, and choose a loan plan that fits your budget—all in just seconds.