When you plan to take a loan — whether for a car, home, or personal need — one question always comes first:

“How much will I have to pay every month?”

That’s where EMI (Equated Monthly Instalment) comes in. Understanding EMI helps you plan your finances better, compare loans, and avoid hidden costs.

Let’s break it down in the simplest way possible.

💡 Try our EMI Calculator BD to instantly find your monthly payments for any loan amount, interest rate, and tenure.

What Is EMI?

EMI stands for Equated Monthly Instalment — a fixed payment you make every month to repay your loan.

Each EMI includes two parts:

- Principal — the amount you borrowed.

- Interest — the cost charged by the bank for lending that money.

This way, you pay off both interest and principal together in equal monthly payments until the loan ends.

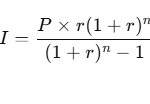

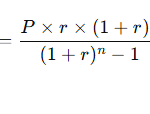

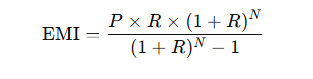

EMI Calculation Formula

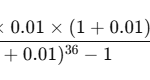

The mathematical formula to calculate EMI is:

Where:

- P = Principal loan amount

- R = Monthly interest rate (annual rate ÷ 12 ÷ 100)

- N = Total number of monthly instalments

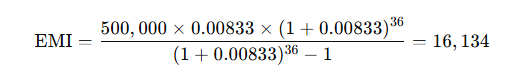

Example: How EMI Works in Real Life

Let’s say you take a loan of BDT 500,000 for 3 years (36 months) at an interest rate of 10% per year.

- P = 500,000

- R = 10 / 12 / 100 = 0.00833

- N = 36

Your monthly EMI = BDT 16,134

Total payment over 3 years = 16,134 × 36 = 580,824

Interest paid = 580,824 – 500,000 = BDT 80,824

Use our Bank Loan Calculator for detailed breakdowns and comparison charts.

Factors That Affect EMI

- Loan Amount (Principal) – Higher amount → higher EMI.

- Interest Rate – Higher rate → higher total cost.

- Loan Tenure – Longer tenure reduces EMI but increases total interest.

- Type of Interest –

- Fixed interest: Same EMI throughout.

- Floating rate: EMI may change if rates change.

To see how interest affects EMI, read our guide on How Interest Works on Loans.

EMI Examples for Popular Bangladeshi Banks

| Bank | Loan Type | Interest Rate (Approx.) | Tenure | EMI for BDT 5 Lakh |

|---|---|---|---|---|

| DBBL | Personal Loan | 9.99 % | 3 years | ≈ BDT 16,000 |

| BRAC Bank | Salary Loan | 10.5 % | 3 years | ≈ BDT 16,200 |

| EBL | Auto Loan | 10 % | 5 years | ≈ BDT 10,600 |

| Prime Bank | Home Loan | 9 % | 10 years | ≈ BDT 6,300 |

(Rates are indicative — confirm with the bank before applying.)

Compare options using:

Simple vs Compound Interest in EMI

Most EMIs are based on reducing balance interest, meaning interest is calculated on the outstanding principal each month (a form of compound interest).

That’s why early payments save more on interest. To understand the difference, see our Simple vs Compound Interest Guide.

Prepayment and Early Settlement

Many banks in Bangladesh allow you to prepay or settle your loan early, but with a small charge (usually 1 – 2 % of remaining principal).

Prepayment reduces your interest burden significantly.

Example:

If you prepay after 1 year on a 3-year loan, you can save 20 – 25 % of total interest.

Read: Understanding EMI Prepayment and Its Benefits in Bangladesh (coming soon on your blog!)

FAQs on EMI Calculation in Bangladesh

1. Can I calculate EMI manually?

Yes — using the formula above, or simply use the EMI Calculator BD for accuracy.

2. What is the minimum loan tenure?

Usually 12 months for personal loans; 5–25 years for home loans.

3. Do Bangladeshi banks use monthly or yearly compounding?

Mostly monthly reducing balance interest.

4. Is EMI the same every month?

Yes, for fixed-rate loans. It can change for floating-rate or variable loans.

5. Can I reduce my EMI without refinancing?

Yes — by prepaying a part of your loan early or extending the tenure.

SADIP is the creator of LoanCalculatorBD.com, a trusted resource for accurate and easy-to-use financial calculators tailored for users in Bangladesh. With a deep understanding of personal finance and local banking needs, SADIP is dedicated to helping individuals make smarter loan decisions. His mission is to simplify complex calculations and empower users with clear, reliable tools for managing their finances with confidence.