When taking out a loan in Bangladesh, one of the first questions you might have is: “How do I calculate my EMI?” The Equated Monthly Installment (EMI) is the fixed amount you need to pay monthly to repay your loan. Calculating your EMI ensures you can plan your finances and avoid financial strain.

What is EMI?

EMI (Equated Monthly Installment) is a fixed monthly payment amount made by a borrower to a lender, typically for a loan. The payment is divided into two parts:

- Principal: The actual amount borrowed.

- Interest: The charge imposed by the lender for the use of their funds.

The EMI is calculated in such a way that the entire loan, including principal and interest, is repaid by the end of the loan tenure.

Formula to Calculate EMI

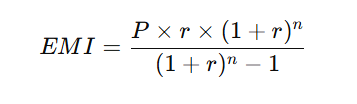

The EMI calculation formula is the same across different loan types. It’s based on the loan amount, interest rate, and tenure. The standard formula to calculate EMI is:

EMI=P×r×(1+r)n(1+r)n−1

How to Calculate EMI in Bangladesh: A Simple Guide

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual interest rate divided by 12 and then divided by 100)

- n = Loan tenure in months (number of months to repay the loan)

Step-by-Step Process to Calculate EMI

1. Determine the Loan Details

To calculate your EMI, you need the following details:

- Loan Amount (P): The total amount you plan to borrow.

- Interest Rate (r): The interest rate charged by the bank or financial institution.

- Loan Tenure (n): The duration for which you will repay the loan, typically in months.

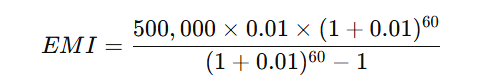

Let’s go through an example:

- Loan Amount: BDT 500,000 (BDT 5 Lakhs)

- Interest Rate: 12% annually (1% per month)

- Loan Tenure: 5 years (60 months)

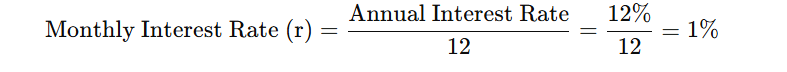

2. Convert the Interest Rate to Monthly Rate

If the annual interest rate is 12%, you need to convert it to a monthly rate:

Monthly Interest Rate (r)=Annual Interest Rate/12=12%12=1%

Next, convert the percentage to a decimal: r=1/100=0.01

3. Use the EMI Formula

After solving, you’ll get the EMI for the loan.

Using a Loan Calculator to Simplify EMI Calculation

While the formula is useful, manually calculating EMI for different loan amounts, interest rates, and tenures can be time-consuming. Instead, you can use an EMI Calculator for a quick and easy solution. Here’s how:

How to Use an EMI Calculator:

- Enter the Loan Amount: Input the amount you wish to borrow.

- Enter the Interest Rate: Type in the annual interest rate (ensure it’s converted to a monthly rate).

- Enter the Loan Tenure: Choose the number of months or years you’ll take to repay the loan.

- Click ‘Calculate’: The EMI Calculator will instantly show you your monthly payment amount.

By using an EMI calculator, you’ll get an instant and accurate result without having to manually apply the formula.

Factors That Affect EMI

Several factors can influence the EMI amount you’ll pay:

1. Loan Amount (P)

- The higher the loan amount, the higher the EMI. Always borrow only as much as you can comfortably repay.

2. Interest Rate (r)

- Even a small increase in the interest rate can significantly affect your EMI. Banks in Bangladesh usually offer fixed or floating interest rates, and it’s important to compare offers before choosing the best one.

3. Loan Tenure (n)

- A shorter tenure results in higher EMIs but lower total interest paid.

- A longer tenure results in lower EMIs but a higher total interest paid over time.

Why is EMI Important?

Understanding your EMI is crucial because it helps you:

- Plan your monthly budget: Know exactly how much money you need to allocate for your loan repayment each month.

- Evaluate loan affordability: Ensure that the EMI fits within your financial capacity.

- Avoid financial strain: By calculating EMI in advance, you can prevent taking on loans with repayment amounts that could cause you financial difficulties.

Tax Benefits on Loan EMI in Bangladesh

In Bangladesh, there are tax benefits for individuals who take out certain types of loans:

- Home Loan: You can claim tax deductions on the interest paid on home loans under the Income Tax Ordinance 1984.

- Education Loan: The interest paid on student loans may also qualify for tax deductions.

These deductions can reduce your overall taxable income, which can help you save on taxes.

Using the EMI Calculator to Compare Loan Offers in Bangladesh

A Loan EMI Calculator is an essential tool when comparing loan offers from different financial institutions in Bangladesh. Here’s how you can use it effectively:

- Input the loan amount, interest rate, and tenure for each loan offer.

- Compare the EMI for each loan to see which one fits your budget.

- Take note of the total repayment amount and total interest to determine which loan is the most cost-effective.

By using the EMI Calculator, you’ll be able to make informed decisions on which loan to choose based on monthly payments, interest costs, and loan terms.

SADIP is the creator of LoanCalculatorBD.com, a trusted resource for accurate and easy-to-use financial calculators tailored for users in Bangladesh. With a deep understanding of personal finance and local banking needs, SADIP is dedicated to helping individuals make smarter loan decisions. His mission is to simplify complex calculations and empower users with clear, reliable tools for managing their finances with confidence.