When you’re planning to take a loan in Bangladesh, two popular names usually come up — IDLC Finance Limited and IFIC Bank PLC.

Both offer reliable loan options, but they cater to slightly different types of borrowers. So how do you decide which one fits your needs better?

This guide explains how to compare IDLC vs IFIC loans step by step, with real examples, rate differences, and practical tips for borrowers in 2025.

IDLC vs IFIC: The Key Difference

The first thing to understand is that IDLC is a non-banking financial institution (NBFI), while IFIC is a commercial bank.

That difference affects interest rates, eligibility, and even approval speed. To find the best repayment plan, try the Personal Loan EMI Calculator BD and adjust your loan tenure.

| Feature | IDLC Finance Limited | IFIC Bank PLC |

|---|---|---|

| Type | Non-Banking Financial Institution | Commercial Bank |

| Interest Rates (2025) | 11.5% – 13.5% | 10.75% – 12.25% |

| Maximum Tenure | Up to 15 years | Up to 20 years |

| Processing Fee | 1% – 1.5% | 1% – 1.25% |

| Loan Types | Personal, Home, Auto, SME | Personal, Home, Business, Auto |

| Approval Speed | Faster processing | More documentation |

| Best For | Entrepreneurs, flexible borrowers | Salaried or home buyers |

If you’re looking for fast approval and flexible criteria, IDLC might suit you better.

If you need a long-term, lower-rate loan, IFIC is usually the smarter option. To understand your monthly payment details, try Loan Calculator BD for quick and accurate results.

How to Compare IDLC and IFIC Loans Step by Step

Here’s a simple way to evaluate both lenders before you apply.

1. Check Current Interest Rates

Interest rates change depending on your income, loan purpose, and credit profile.

As of 2025:

- IDLC’s personal loans start around 11.5%, while IFIC’s start near 10.75%.

- Home loans are cheaper at IFIC (around 9.5%).

- IDLC’s SME and auto loans have slightly higher rates but quicker disbursement.

To test the impact of rate changes, use the Interest Calculator BD — it helps you see how small rate differences affect your total repayment.

2. Compare EMI (Monthly Payment)

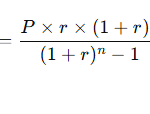

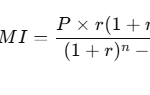

Your EMI depends on three things — loan amount, interest rate, and tenure.

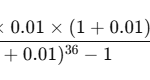

Example

Loan amount: BDT 10,00,000

Tenure: 5 years

Interest: 12% (IDLC) vs 11% (IFIC)

| Bank | EMI (Approx.) | Total Interest | Total Payable |

|---|---|---|---|

| IDLC Finance | BDT 22,244/month | BDT 3,34,640 | BDT 13,34,640 |

| IFIC Bank | BDT 21,739/month | BDT 3,04,340 | BDT 13,04,340 |

Even a 1% rate difference can save around BDT 30,000–40,000 over 5 years.

If you want to try this yourself, check the Bank Loan Calculator — it shows EMI, total interest, and payment schedules instantly.

3. Evaluate Eligibility and Documentation

| Criteria | IDLC Finance | IFIC Bank |

|---|---|---|

| Minimum Income | BDT 30,000/month | BDT 25,000/month |

| Employment Type | Salaried / Self-employed / SME | Salaried / Business / Govt Employee |

| Age Limit | 25 – 60 years | 23 – 60 years |

| Documents Required | NID, bank statement, income proof | NID, TIN, salary slips, proof of address |

| Credit Report (CIB) | Required | Required |

If you’re a business owner or freelancer, IDLC might be more lenient with income verification.

IFIC prefers salaried applicants with steady income and salary account history. If you want to see total interest over time, use our Installment Loan Calculator for quick insights.

4. Look Beyond Interest Rate

A lower rate doesn’t always mean a better deal.

Consider these hidden factors before deciding:

- Processing fees: Add 1–1.5% to total cost.

- Prepayment charge: Both IDLC and IFIC charge 1–2% if you pay early.

- Loan insurance: IFIC may include mandatory insurance for large loans.

- Customer service: IDLC has a more personalized approach; IFIC offers digital services like the Aamar IFIC App.

You can test the total repayment difference by using the Installment Loan Calculator.

IDLC vs IFIC: Which One Should You Choose?

| Borrower Type | Recommended Lender | Why |

|---|---|---|

| Salaried Employee | IFIC Bank | Lower rates, longer tenure, stable EMI |

| Self-Employed or SME | IDLC Finance | Easier approval, flexible documentation |

| First-time Home Buyer | IFIC Bank | 20-year tenure, strong mortgage support |

| Urgent Fund Need | IDLC Finance | Faster processing, less red tape |

Both are good — it depends on your priorities:

- Choose IFIC for lower interest and longer-term stability.

- Choose IDLC for speed and flexibility if you’re self-employed or managing multiple loans.

Practical Tips Before Choosing Between IDLC and IFIC

- Check your credit score from Bangladesh Bank’s CIB before applying.

- Use a loan calculator to visualize monthly EMI and interest differences.

- Negotiate processing fees — both institutions allow limited flexibility.

- Compare total repayment, not just rate — longer tenures cost more overall.

- Ask about prepayment options if you expect to repay early.

For deeper comparisons, explore the IFIC Loan Calculator or IDLC Loan Calculator for tailored results.

Frequently Asked Questions

1. Which is cheaper, IDLC or IFIC Bank loan?

IFIC usually offers slightly lower rates and longer tenures, making it cheaper for salaried borrowers.

2. Which lender has faster approval?

IDLC Finance processes loans faster, often within 3–5 working days.

3. Who can get a loan more easily — IDLC or IFIC?

IDLC tends to approve more self-employed and SME applicants, while IFIC prefers salaried customers.

4. What’s the average processing fee difference?

Both charge around 1–1.5%, but IFIC sometimes waives partial fees for long-term home loans.

5. Which is better for business loans?

IDLC offers more flexible terms and dedicated SME loan programs.

SADIP is the creator of LoanCalculatorBD.com, a trusted resource for accurate and easy-to-use financial calculators tailored for users in Bangladesh. With a deep understanding of personal finance and local banking needs, SADIP is dedicated to helping individuals make smarter loan decisions. His mission is to simplify complex calculations and empower users with clear, reliable tools for managing their finances with confidence.