SCB Personal Loan Calculator

Estimate your Standard Chartered monthly installments

Repayment Summary

Repayment Schedule

| Month | Principal | Interest | Balance |

|---|

SCB Personal Loan Calculator Bangladesh – Quick EMI Estimator

Looking for a quick and accurate way to calculate your monthly personal loan payments? The SCB Personal Loan Calculator helps you estimate your EMI (Equated Monthly Installment) instantly based on your loan amount, interest rate, and loan tenure. Whether you’re planning to borrow for education, travel, home improvement, or any personal need—this calculator gives you a clear financial outlook before you apply.

This tool is especially useful for planning your budget, comparing loan options, and avoiding surprises in repayment. It’s fast, reliable, and tailored for loans in BDT (Bangladeshi Taka).

If you want complete transparency, LoanCalculator BD reveals every part of your EMI calculation.

How the SCB Personal Loan Calculator Works

The calculator uses a standard EMI formula to compute your monthly payment, total interest payable, and total amount due over the loan period.

Input Fields Explained

- Loan Amount (BDT): The total money you wish to borrow.

- Annual Interest Rate (%): The yearly rate charged by the bank.

- Loan Tenure (Years): The number of years you plan to repay the loan.

Each of these inputs plays a key role in determining your monthly EMI and overall loan cost.

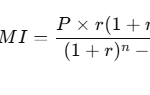

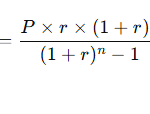

EMI Calculation Formula

The EMI is calculated using this formula:

EMI = [P × r × (1 + r)^n] / [(1 + r)^n – 1]

Where:

- P = Loan Amount

- r = Monthly Interest Rate (Annual Rate ÷ 12 ÷ 100)

- n = Total Number of Monthly Payments (Loan Tenure × 12)

This formula ensures a fixed monthly payment that includes both principal and interest components.

Example Calculation (How You Can Verify It)

Let’s test the calculator with a real example, using the exact values shown in your calculator:

- Loan Amount: BDT 500,000

- Interest Rate: 9.5% annually

- Loan Tenure: 5 years (60 months)

Based on these values, the calculator gives:

- Monthly EMI: BDT 10,501

- Total Interest Payable: BDT 130,056

- Total Payment: BDT 630,056

What It Means

You’ll pay BDT 10,501 each month for 5 years. By the end of the loan period, you will have paid BDT 130,056 in interest. The total amount you repay will be BDT 630,056. This helps you clearly understand the full cost of borrowing and make better financial decisions.

Benefits of Using This Calculator

Here’s why the SCB Personal Loan Calculator is a helpful tool for anyone considering a loan:

- Instant Calculations – See your EMI within seconds.

- No Math Required – The formula is built-in, so you don’t have to crunch numbers.

- Better Loan Planning – Know exactly what you’ll pay before committing.

- Compare Different Scenarios – Change interest rates or tenure to see what fits best.

- Transparent and Accurate – Results are based on standard financial formulas.

Tips and Common Mistakes to Avoid

Even though the calculator is user-friendly, here are some helpful tips:

Tips

- Enter realistic values based on your loan eligibility.

- Try different tenures to see how EMI changes.

- Use the tool to compare loan offers from different banks.

Common Mistakes

- Don’t confuse monthly interest with annual interest—always input the annual rate.

- Make sure you’re entering the tenure in years, not months.

- Don’t leave any fields blank before clicking “Calculate EMI”.

- Personal Loan Calculator – general personal loan EMI estimation

- EMI Calculator BD – calculate monthly installments

- Standard Chartered Loan Calculator – broader SCB loan calculations

- Bank Loan Calculator – compare SCB personal loans with other banks

- Interest Calculator BD – understand interest impact on EMI

- How to Calculate EMI in Bangladesh – educational EMI guide

Frequently Asked Questions (FAQs)

1. What is EMI and why is it important?

EMI stands for Equated Monthly Installment. It’s the fixed amount you pay every month until the loan is fully repaid. Understanding your EMI helps you manage your budget and avoid debt stress.

2. Is the EMI the same for all banks?

While the EMI formula is standard, actual payments may vary slightly based on bank policies, fees, or compounding methods. This calculator gives a close estimate.

3. Can I change my tenure or loan amount later?

Some banks allow tenure adjustments or partial prepayments. Use the calculator to see how such changes affect your EMI and total interest.

4. What happens if I repay early?

Early repayment can reduce your interest cost. However, check with your lender about prepayment charges, if any.

5. Is this calculator useful for other types of loans?

Yes, the EMI formula is also used for home, car, or education loans—just make sure to input the correct values for the specific loan type.

Conclusion

The SCB Personal Loan Calculator is your go-to tool for smart loan planning. It helps you understand exactly how much you’ll pay monthly, how much interest you’ll owe, and how to choose a loan that fits your budget.